Since 2017, ReLondon’si Business Transformation programme has been helping businesses innovating around ‘packaging-free’ grocery shopping to grow and thrive in the capital.

We’ve seen a range of different solutions emerge in London to help us shop for foodstuff with less single-use packaging – ranging from small shops offering groceries in bulk in bring-your-own containers, to larger online grocers selling groceries in reusable packaging and taking containers back when customers are finished.

We found that while there is a clear audience for packaging-free grocery shopping in London, it is still small. Retailers with packaging-free solutions will need to consider how they meet needs other than sustainability if they want to attract a more mainstream crowd. But going for the mainstream isn’t the only way to grow their impact; packaging-free solutions could also consider a more targeted approach, doubling down on niche preferences which can still represent a healthy market size.

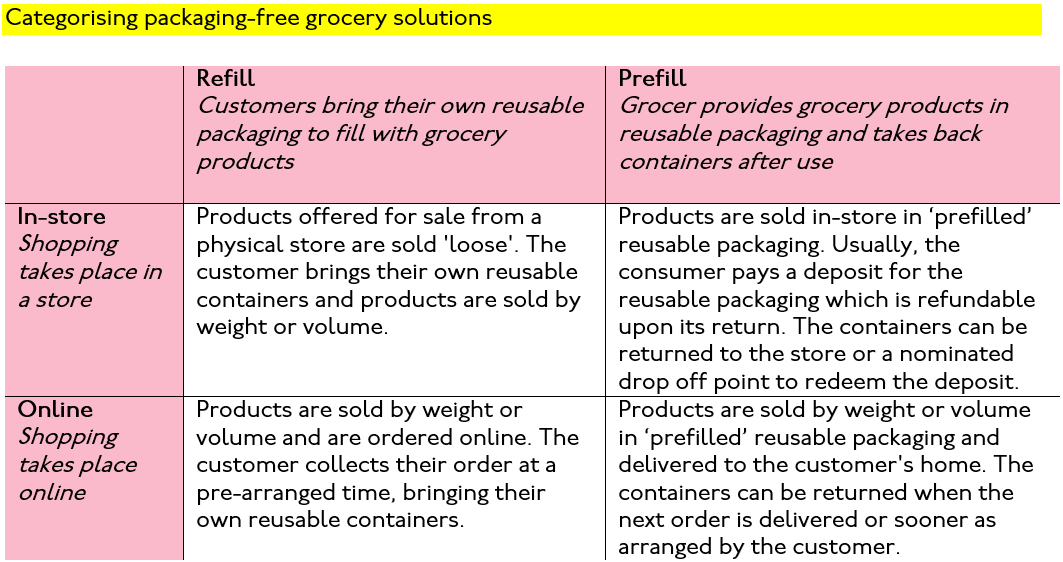

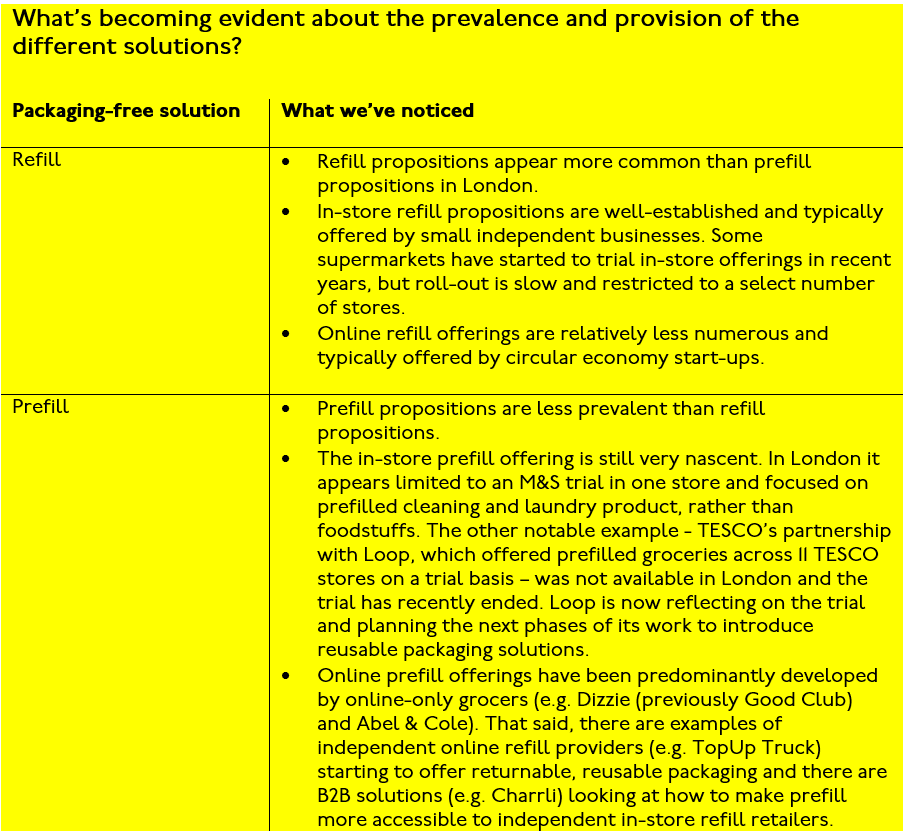

1. There are a variety of ways to shop packaging-free in the capital.

There is a diversity of packaging-free grocery shopping solutions in London, offering different customer experiences based on who provides the reusable packaging (the customer or grocer) and where the shopping takes place (online or in-store).

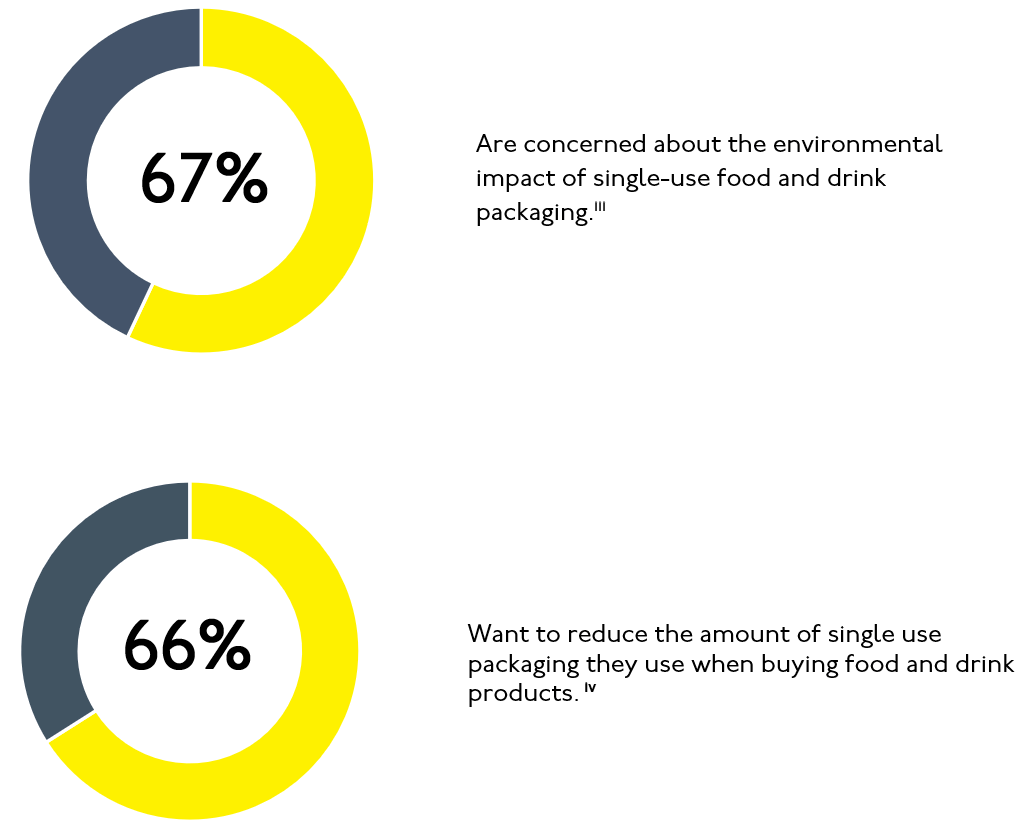

2. The range of choice is good news because a lot of Londoners want to tackle the packaging of their groceries.

The majority of Londoners are worried about the environmental impact of the single-use food and drink packaging they buy and want to reduce the amount they use.

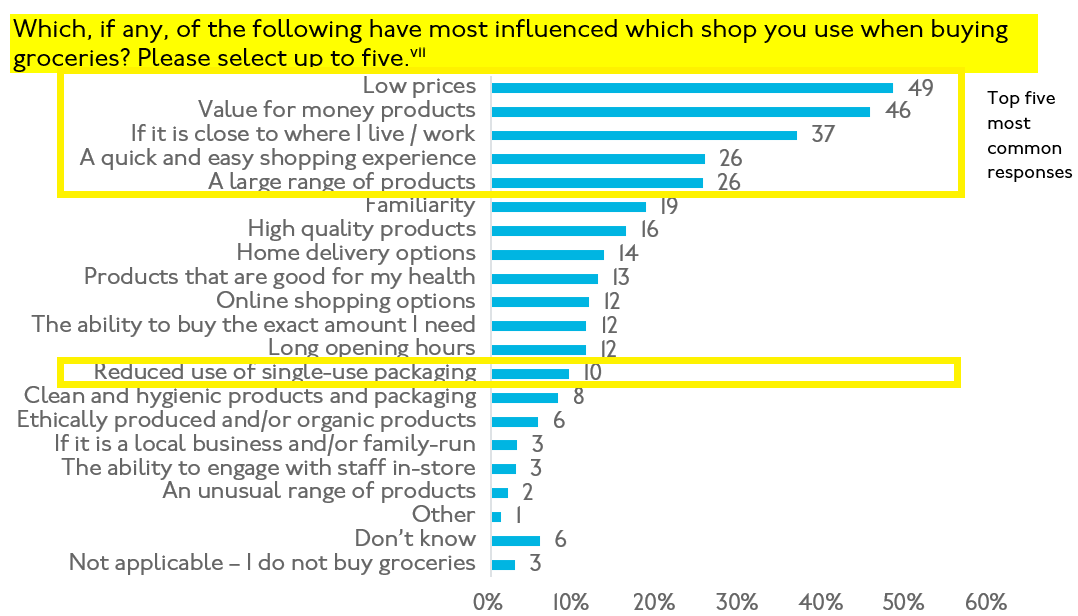

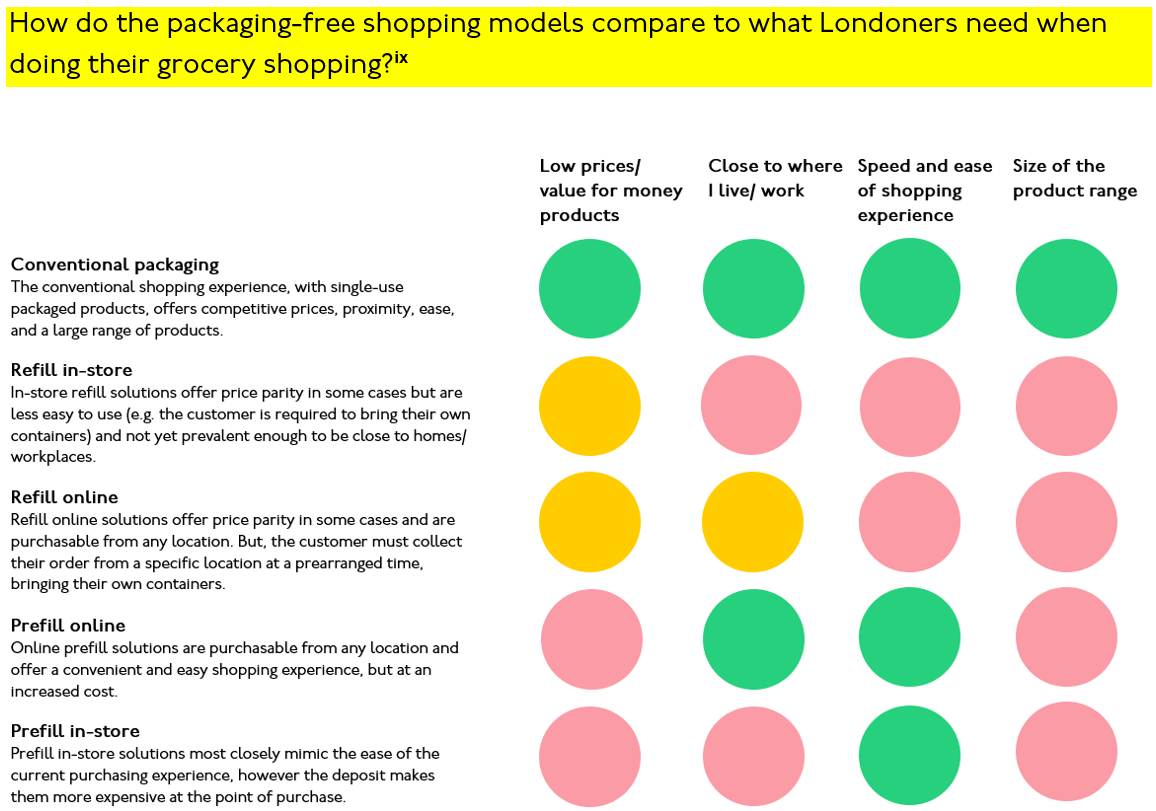

3. However, in practice most Londoners are influenced by price, proximity, and ease, rather than reduced single-use plastic when deciding where to shop for their groceries.

Only a small segment of Londoners are influenced by reduced single-use packaging when deciding where they do their grocery shopping.

For most Londoners price or value-for-money – not packaging – is key in determining where they buy their groceries,vi followed by proximity of the store to their home or workplace, ease of the shopping experience, and the size of the product range.

As the cost-of-living crisis continues, price may become an even more important factor for consumers struggling to manage increased household food bills.

4. That’s why packaging-free solutions will need to consider how they meet needs other than sustainability if they want to appeal to the mainstream market.

Shoppers have grown accustomed to a conventional shopping experience that offers competitive prices, proximity, and ease. Packaging-free options, which haven’t yet reached a critical mass, aren’t the easy, obvious choice for them. Until this changes, providers of packaging-free solutions will need to carefully consider how else their value proposition can appeal to a mainstream crowd.

When all factors are considered, prefill online offerings are the closest match to conventional packaging and so occupy pole position in the race for the large mainstream market. But, all packaging-free solutions score well against at least one of the key factors. Solutions that want to attract a more mainstream audience should double down on these (e.g. through focused marketing messages that emphasise these factors) while at the same time improving their performance against those attributes that they score less well on.

Price, for example, varies greatly across (and within) the different packaging-free offerings. While refills (in-store and online) can offer price parity with the disposable equivalent, prefills are more expensive and so will need to focus on accessibility and ease of experience in order to compete with the conventional grocery offers for the mainstream.

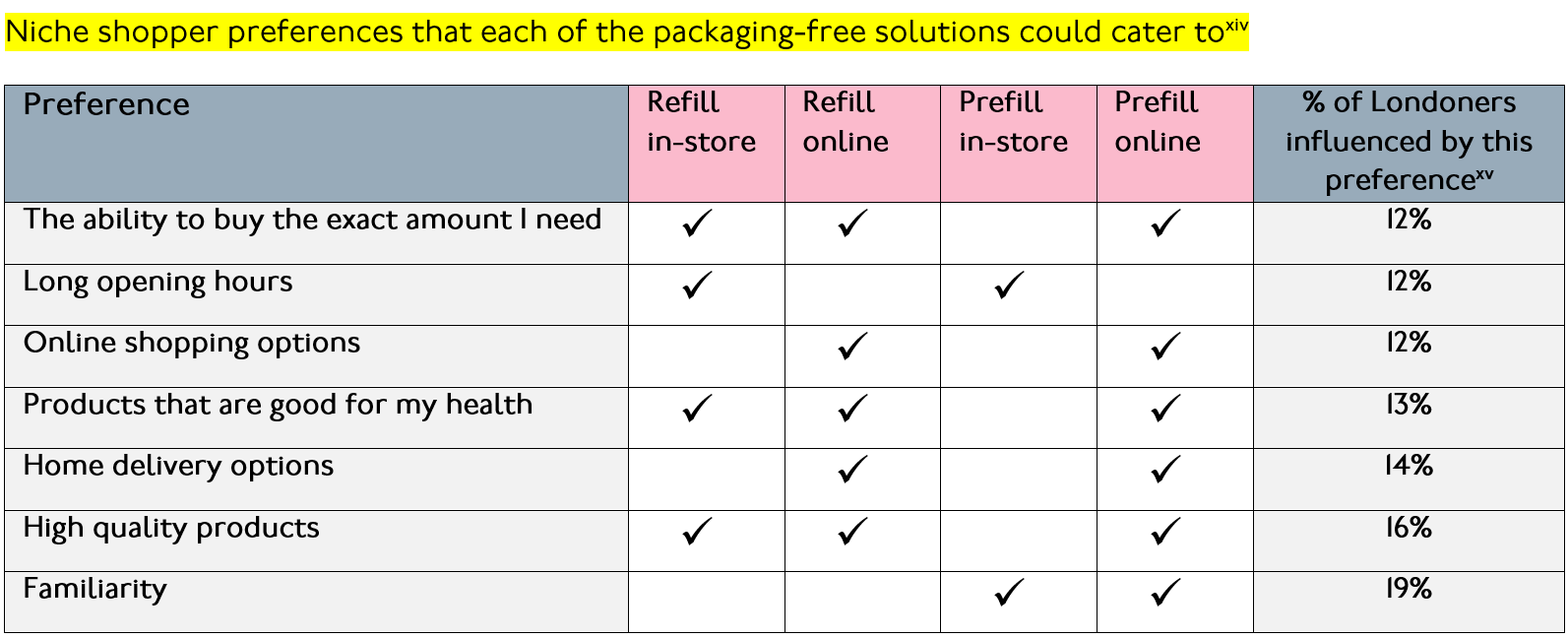

5. But mainstreaming is not the only way forward for packaging-free solutions; they can also appeal to the niche.

Niche preferences can still represent a healthy market size for certain providers of packaging-free solutions, particularly small businesses. For example, over 15% of respondents factored the quality of products in their shopping decisions, which if extrapolated across London could represent 1 million customers.xiii

We’ve identified a list of these less common shopper preferences which each of the packaging-free solutions could cater to. That could be by redesigning parts of their service or investing in specific, targeted marketing.

Conclusion

If you are a packaging-free grocery shopping solution in London, you have the opportunity to have more impact by making your solution more attractive to consumers, regardless of whether they care about sustainability. To achieve this you could appeal to the mainstream, focusing on improving your performance against the factors that the majority of shoppers prioritise such as price, proximity and ease. But going for the mainstream isn’t the only way to scale; you could also consider a more targeted approach, focusing on appealing to niche preferences which can still represent a healthy market size.

How ReLondon can help

Get in touch with ReLondon’s business transformation team today by emailing business@relondon.gov.uk

ReLondon’s business transformation team empowers London’s businesses to embrace circularity, transforming the way they work and creating long-term sustainable value and growth. We provide expert, practical, one-on-one support and consultancy to forward thinking corporates, SMEs and start-ups to develop circular business models that are resilient and fit-for-the-future.

ReLondon’s business transformation programme is part funded by ReLondon and the European Regional Development Fund.

——————————————————————–

[i] ReLondon is a partnership of the Mayor of London and the London boroughs to improve waste and resource management and transform the city into a leading low carbon circular economy.

[ii] This map provides an indicative rather than precise depiction of London’s packaging-free solution providers. It draws heavily on ReLondon’s portfolio of SMEs as a data source, which is not representative of the packaging-free sector in London.

[iii] Hubbub research survey. Total sample size was 3000. Fieldwork was undertaken between 4th –7th April 2022. The figures presented here are for the Greater London segment of the sample, which represents 13% of the total sample size, and represent those that have agreed (net) with the following statement: “I’m concerned about the environmental impact of single use food and drink packaging”. Raw data is available here: https://www.hubbub.org.uk/our-polling-data

[iv] Hubbub research survey. Total sample size was 3000. Fieldwork was undertaken between 4th –7th April 2022. The figures presented here are for the Greater London segment of the sample, which represents 13% of the total sample size, and represent those that have agreed (net) with the following statement: “I want to reduce the amount of single use packaging I use when buying food and drink products”. Raw data is available here: https://www.hubbub.org.uk/our-polling-data

All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 1245 adults. Fieldwork was undertaken between 15th – 20th July 2022. The survey was carried out online. The figures have been weighted and are representative of all London adults (aged 18+).

[v] Ibid.

[vi] Ibid.

[vii] Ibid.

[vii] Ibid.

[viii] Hubbub research survey. Total sample size was 3019. Fieldwork was undertaken between 25th April – 2nd March 2022. The figures presented here are for the Greater London segment of the sample for the question “Have you started to make or do you plan to make any of the following cutbacks in the coming weeks/months? Buy less or cheaper food (e.g. less meat/frozen/ready meals). Raw data is available here: https://www.hubbub.org.uk/our-polling-data

[ix] Ease of use was assessed qualitatively using a number of criteria including: whether the customer has to bring their own containers, whether the customers has to return containers, whether the customer needs to download an app to participate in the proposition.

[x] Assumes that products are sold at the same or cheaper price than the equivalents packaged in single-use packaging: https://corporate.asda.com/newsroom/2021/11/19/asda-opens-refill-store-in-milton-keynes

[xi] Ibid.

[xii] Includes deposit costs.

[xiii] London population data sourced from https://data.london.gov.uk/dataset/londons-population and includes all age groups.

[xiv] Informed by data collected from YouGov Plc. Total sample size was 1015 adults. Fieldwork was undertaken between 17th – 22nd June 2022. The survey was carried out online. The figures have been weighted and are representative of all London adults (aged 18+). https://data.london.gov.uk/dataset/gla-poll-results-2022

[xv]This column represents the % of adults in London who are influenced by any particular preference or factor in their decision-making about where they do their grocery shopping. All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 1245 adults. Fieldwork was undertaken between 15th – 20th July 2022. The survey was carried out online. The figures have been weighted and are representative of all London adults (aged 18+).